Alcova Capital’s home is the 43rd floor of the GE Building, an Art Deco icon built in 1931 to house RCA and later its parent General Electric.

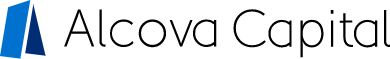

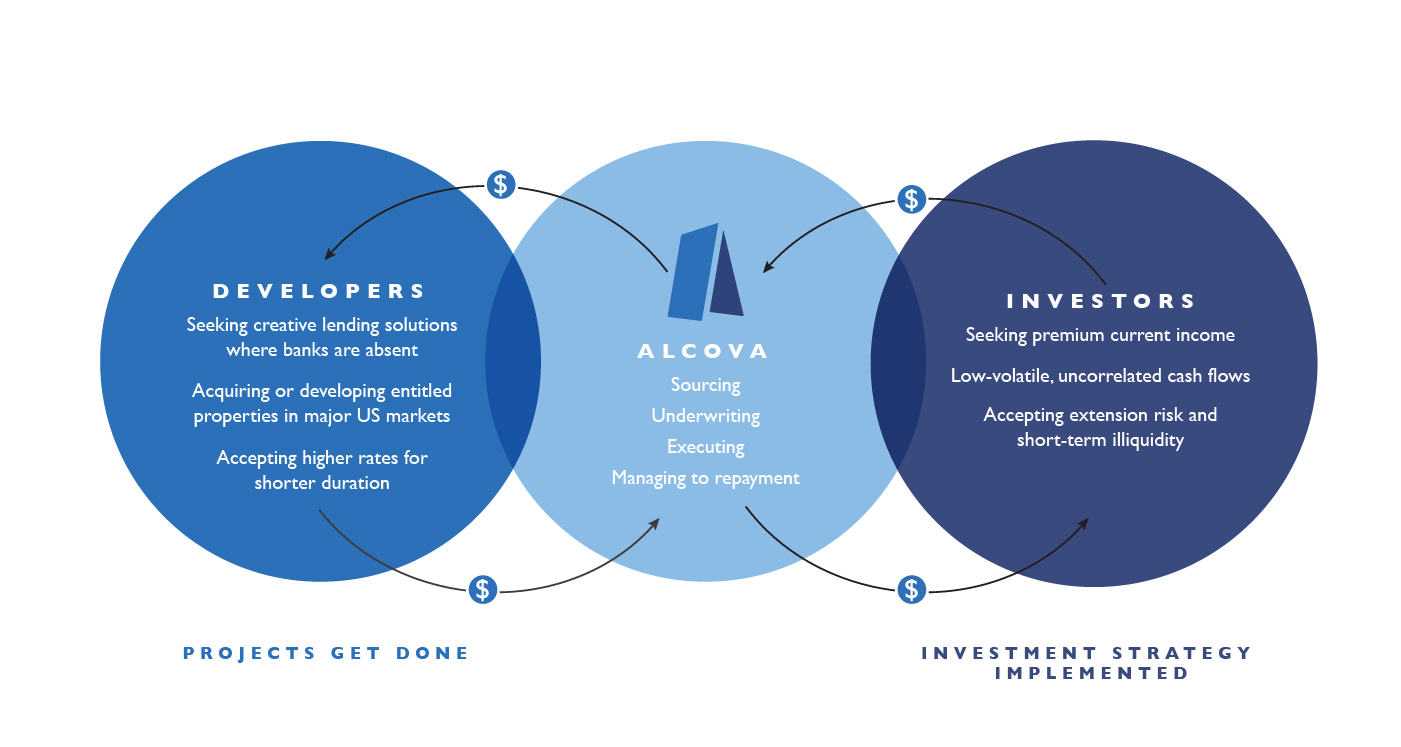

Alcova provides commercial real estate developers flexible bridge lending solutions.

Alcova offers investors robust, uncorrelated and contractual income.

Our Strategy

Alcova builds on its longstanding real estate industry relationships to source, evaluate, underwrite, execute on and manage real estate bridge loans.

Privately originated real estate investments:

Bridge Lending

Alcova takes a flexible and creative approach with a speed and certainty of execution to help borrowers acquire properties and execute on their business plans.

B-Notes/Mezzanine Loans/Preferred Equity

Alcova can provide a one-stop financing solution by pairing a senior bridge loan with subordinate debt or preferred equity.

Opportunity Zone Equity

Alcova utilizes its lending platform to source opportunistic, bespoke Qualified Opportunity Zone equity investments.

ALCOVA / ‘al’kōv’a / noun: Italian; translation: alcove

A niche inlay apart from a greater space, denoting a unique purpose and role

A place apart from the trafficked mainstream, offering a recess from the crowd

Alcova Capital seeks to deliver attractive risk-adjusted returns from structurally inefficient niche markets

Lending Portfolio

Our bridge loans provide transitional financing to commercial real estate developers with valuable assets. Characteristics include:

- Premier U.S. markets, a defensive approach which tends to offer more liquidity and recovery from recession

- A preference for easier lease-up properties and more proximate cash flow

- Target $5-50 million loans which show visibility to repayment in 9-18 months

- Consideration of pre-development/land, small-scale construction, re-lease, value-add and master plan lending

Opportunity Zone Equity

Utilizing our bridge lending network to secure Opportunity Zone equity investments which have the following characteristics:

- High growth markets

- Investments underwrite on a stand-alone basis

- Enhanced upside through favorable tax characteristics, including deferral of capital gains, reduction in capital gains and tax-free returns on investment on a 10-year hold

- Lending Portfolio

- Opportunity Zone

(Click on locations to learn more)

Team

Alcova’s management team has relevant real estate, investment banking, asset management and operational experience.

Russell earned an MBA from Columbia University and a BA from Cornell University in Government and Italian Literature.

He is a trustee emeritus and served as Investment Chair and Treasurer of Children's Aid, the largest children's welfare agency in New York City. Russell and his wife Mica have two grown children and a golden retriever named Giorgio. He co-founded the Sag Harbor Cycle Company and is an avid cyclist, kiteboarder and skier.

Matthew was a Managing Director at Spectrum Group Management, an asset manager focused on direct lending and distressed credit. He began his career as an investment banker at JPMorgan in the real estate, gaming and lodging group where he advised clients on over $10 billion of debt, equity and M&A transactions.

Matthew graduated with a BS from Cornell University. He lives in Armonk, NY with his wife and two children. He’s an active angel investor in early-stage technology companies. Representative venture-backed SaaS and Fintech companies include AngelList, Bread, CompStak, Dataminr, Pluralsight and RealtyMogul.

Before Alcova, Tristan was a Finance Manager at Benefit Street Partners, where he was responsible for finance, accounting, reporting, operations and valuation for the firm’s credit strategies. He was previously part of the finance team at Fifth Street Asset Management and began his career in public accounting with a regional firm.

Tristan holds a Bachelor of Science in Accounting from the State University of New York at New Paltz. He resides in Fairfield, CT with his wife and children and is an avid cyclist.

Prior to joining Alcova Capital, Sam was an Investment Associate at Corridor Ventures, a real estate investment company. He began his career as a member of Wheel Program at CBRE, a 14-month rotational program in which associates rotate through four different groups in various subsectors of the real estate industry.

Sam graduated with high distinction from the University of Michigan. He lives in Melville, NY with his wife and two children and is an avid golfer.

Prior to joining Alcova Capital, Brent was a Senior Analyst at Capital One. At Capital One, Brent was a member of the Commercial Real Estate Strategy team, which focused on growth initiatives to boost efficiency and profitability within the Commercial Real Estate Lending platform. Prior to this role, Brent worked as an Analyst on the Commercial Loss Forecasting team at Capital One.

Brent graduated Magna Cum Laude with a double major in Finance and Accounting from the Olin Business School at Washington University in St. Louis.

Contact

ALCOVA CAPITAL MANAGEMENT LP

570 Lexington Avenue, 43rd Floor

New York, NY 10022

GENERAL: investors@alcovacap.com

BORROWERS: borrowers@alcovacap.com